- UK National Offices |

- 24/7 Customer Helpline |

- Call Now, Free Consultation |

- Calls Are Free From Mobile and Landline

Beteast Bonus Password, 100 percent check this out site free Possibilities Or take a peek at in the Also provides

August 27, 2024Bitcoin Gaming: Online game & Bonuses Play, Winnings, Recite!

August 27, 2024At Debts, we strive so you can make economic conclusion with confidence. While many of the affairs reviewed are from the Companies, and additionally those with which our company is connected and those that compensate us, all of our analysis will never be determined by them.

Merely cash out mortgage readily available

In today’s market, zero actual advantages as Chase doesn’t always have domestic security issues. They give you a cash-out home loan, that’s fundamentally a bad choice when you yourself have a lower financial rates.

Generally speaking, Chase Financial even offers HELOCs but does not promote house collateral fund. Already, due to market criteria Chase isnt giving HELOCs but advises considering a finances-away refinance loan.

Prior to COVID, Pursue Bank considering two domestic security capital possibilities: Home security personal lines of credit and money-aside refinancing. A house collateral personal line of credit otherwise HELOC is actually an effective rotating line of credit. Borrowers normally mark facing it as necessary to finance renovations otherwise repairs, defense advanced schooling expenses, combine financial obligation, or money a giant-pass get.

Pursue Financial ‘s the user and you can commercial banking department out of JPMorgan Pursue & Co. (NYSE: JPM). Established inside the 1799, its among the many earliest and you will prominent financial institutions regarding the You.S. Pursue Financial has actually more cuatro,700 branches across the country while offering lenders, together with domestic security personal lines of credit and money-aside refinancing, inside 47 claims. HELOCs are not revealed within the Alaska, Their state, otherwise South carolina. The bank scored a score out of 843 from inside the JD Power’s 2021 United states First Home loan Origination Pleasure Survey

Chase Bank Solution Domestic Security Activities

Cash-out refinancing pertains to substitution a preexisting home loan with a brand new domestic loan, ideally within less interest rate. The key mission which have a funds-away refi is always to withdraw collateral during the bucks; consumers receive a lump sum from the closing in the place of gaining supply so you’re able to a credit line. Refinancing which have a profit-away mortgage can be more high priced than simply taking out fully a beneficial HELOC, while the practical settlement costs out of dos% in order to 5% of your amount borrowed use. These types of household security capital is far more appropriate whenever borrowers could possibly get a far greater contract on their loan words and want a massive sum of cash at once.

Unsecured loans will likely be a different way to rating dollars if needed. A consumer loan is going to be secure otherwise unsecured; secured personal loans that use a property as collateral are fundamentally house guarantee loans. Pursue doesn’t render old-fashioned personal loans, have a peek at these guys although My personal Pursue Loan are a choice. It loan allows consumers which have a good Pursue mastercard to borrow money facing its card’s borrowing limit in place of requiring him or her to-do another type of application for the loan.

Researching Family Equity Items

Bringing a beneficial Pursue family security mortgage isn’t really an option, as Chase Bank will not promote him or her. When comparing family security loans together with other loan providers, its beneficial to know its elements. Check out of the biggest facts to consider having house equity loans:

- Limitation mortgage-to-really worth (LTV) proportion

- Interest rate range

- Whether costs are fixed adjustable

- Minimal official certification, including credit history and you can earnings criteria

- Restriction loans-to-earnings ratio

- Minimum and you will restriction house guarantee mortgage amounts

- Fees words

- Fees, plus origination costs, application costs, settlement costs, and you may prepayment charges

- Extra enjoys, particularly autopay interest offers or customers respect coupons

Using property security finance calculator may help guess credit number according to latest equity yourself. Most loan providers limit the loan-to-really worth shortly after adding a house security mortgage to 80%, many will go so you’re able to 85% if not ninety% to own really-qualified borrowers.

Pursue HELOC

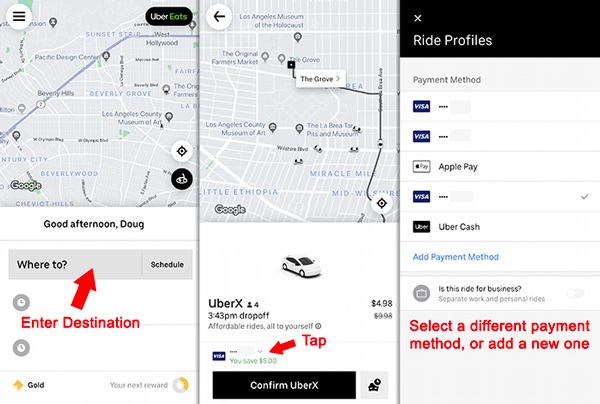

Good Pursue HELOC was a flexible line of credit you to consumers are able to use to consolidate large-attract expense, funds house fixes, otherwise pay money for expensive requests. Now, HELOC programs are not offered. The latest Chase site states one applications usually reopen shortly after sector conditions increase.

Why we think we are the best immigration lawyers and solicitors in the UK

Every day we help people like you. With 5 star reviews, Here are just some of the people we’ve helped this year who are happy they contacted us.

To contact our team of specialists you can call us for FREE 24 hours a day, 7 days a week. Alternatively, you can get in touch by completing our contact form. Call us on: 0203 633 4653